who pays sales tax when selling a car privately in illinois

Steps To Take When Selling A Car In Illinois - Cash Cars Buyer. However you do not pay that tax to the car dealer or individual selling the car.

How Much Sales Tax On A Car In Illinois Car Sale and Rentals.

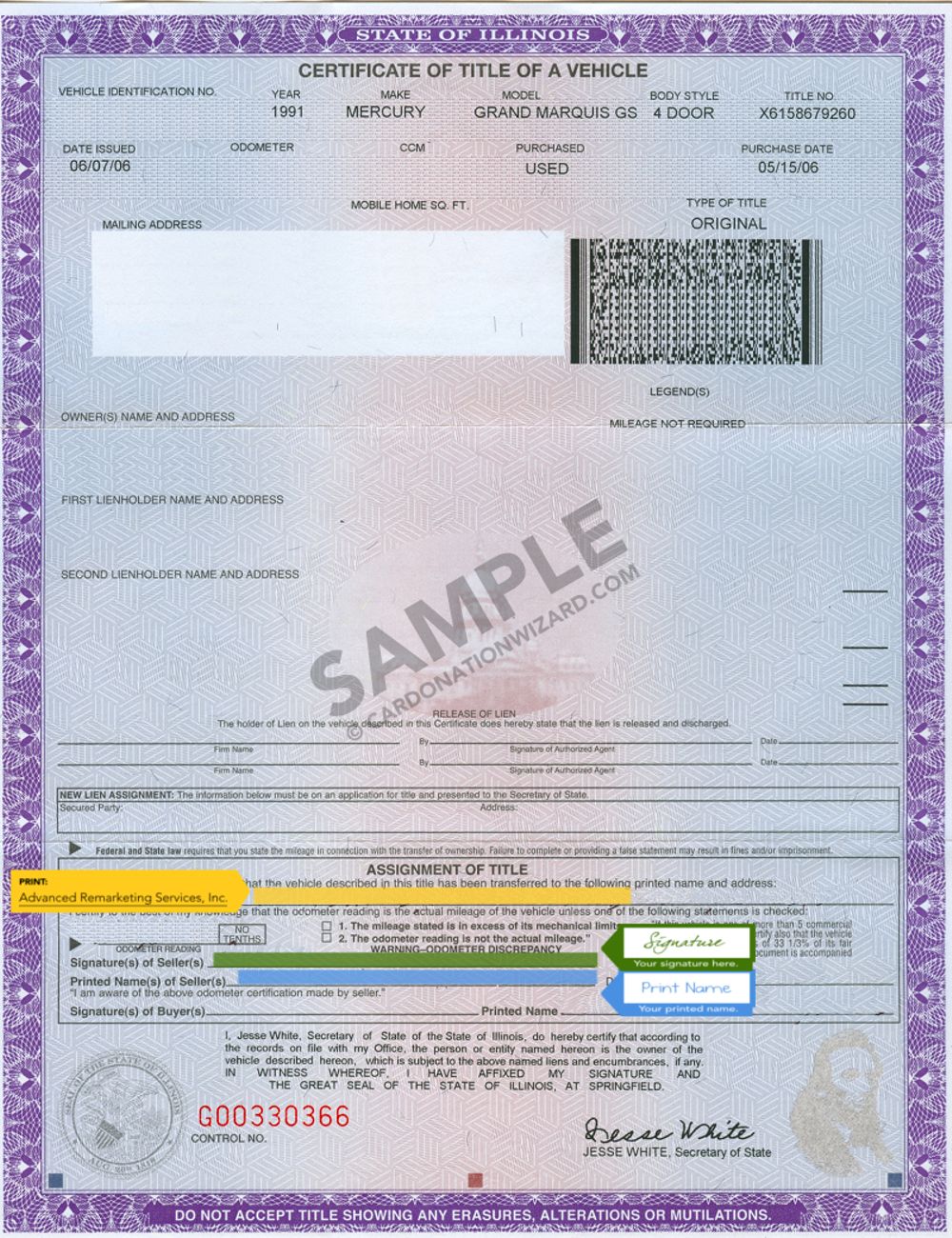

. Who pays sales tax when selling a car privately in illinois. You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. Who pays sales tax when selling a car privately in illinois.

The average total car sales tax paid in New York state is 7915. A list of all the states for which you must collect sales tax and the rate you must charge can be found on the Illinois Department of Revenues website. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets.

Instead the buyer is responsible for paying any sale taxes. However if you sell it for a profit higher than the original purchase price or what is. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

See RUT-6 Form RUT-50 Reference Guide to determine whether you must report any local government private party vehicle use tax on Form RUT-50. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Do not let a buyer tell you that you are supposed to.

This means you do not have to report it on your tax return. It ends with 25 for vehicles at least 11 years old. If I sell my car do I pay taxes.

Transferring License Plates after a Sale. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Do you pay sales tax on a used car from private seller in Illinois.

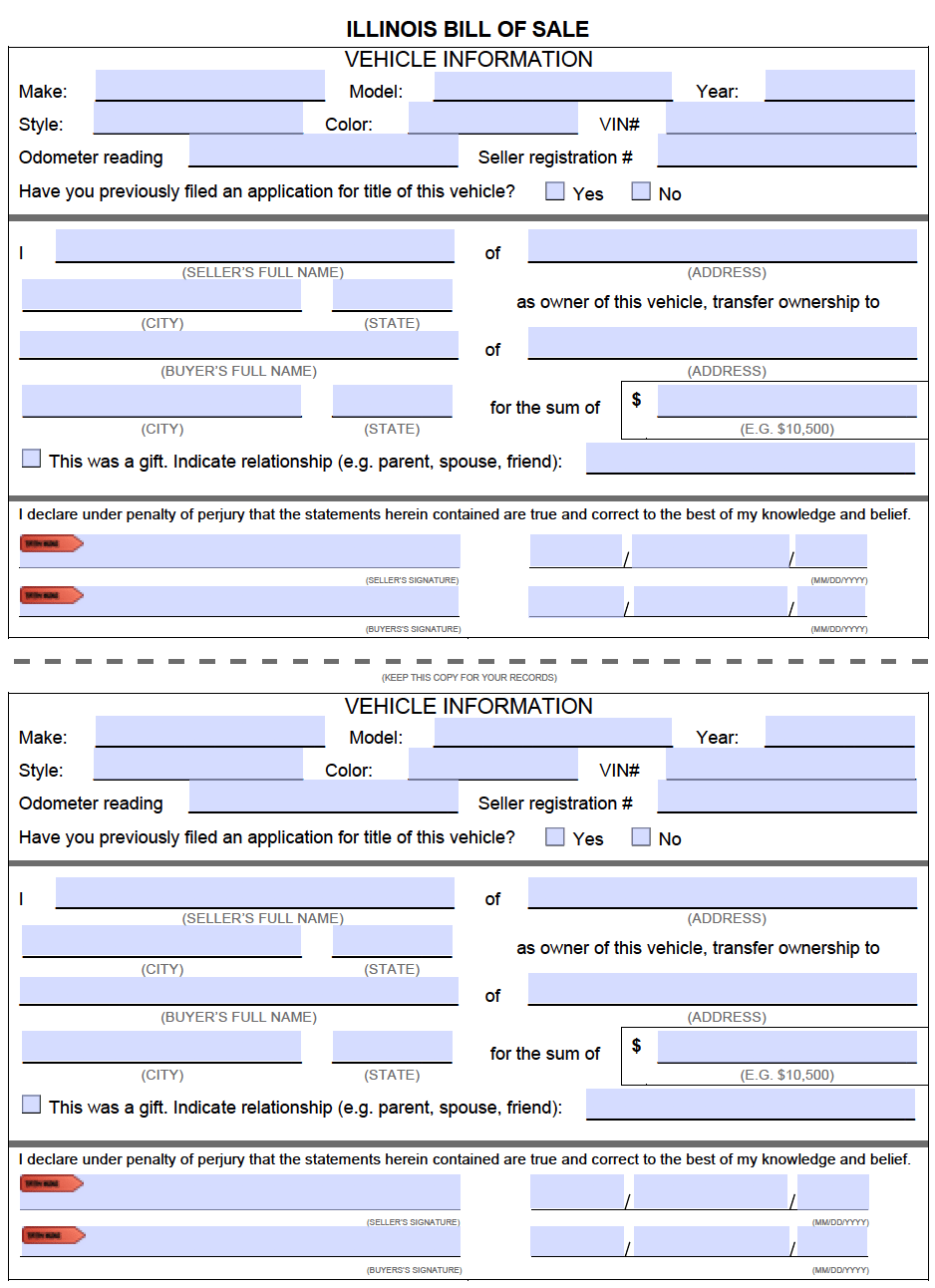

You typically have to pay taxes on a car received as a gift in illinois. Saying a sale is a gift is fraud. To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person.

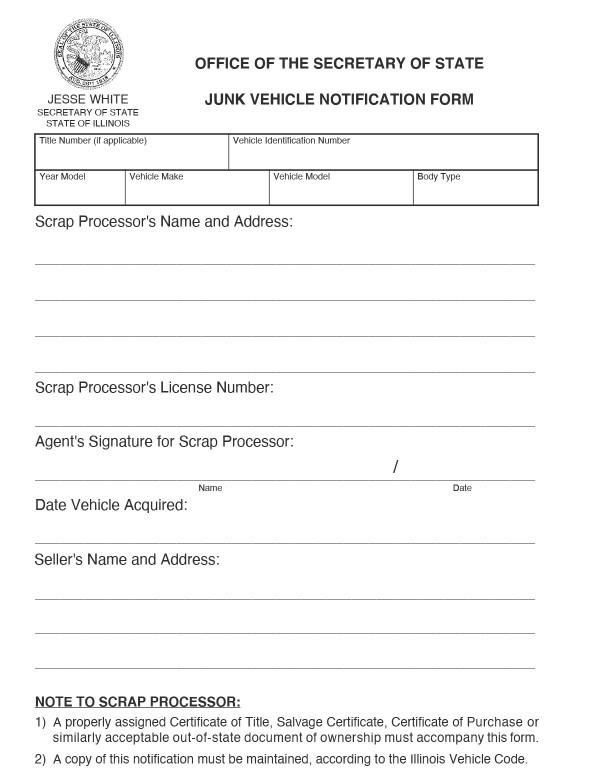

Who Pays Sales Tax When Selling A Car Privately In Illinois. You have to pay a use tax when you purchase a car in a private sale in Illinois. Vehicle use tax for vehicles purchased from another individual or private.

DMV or State Fees. In NSW the duty is calculated at three percent of the cars market value up to 45000 and five percent for any value above 45000. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. If you have problems with a title or registration on Selling a vehicle in illinois. It starts at 390 for a one-year old vehicle.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. The buyer will have to pay the sales tax when they get the car registered under their name. The tax rate is based on the purchase price or fair market value of the car.

When you sell your car in illinois you are obligated to take the following actions. If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax rate or at 625 whichever is less. You will pay it to your states DMV when you register the vehicle.

The cost of a vehicle dealer license to sell new andor. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Exemptions If one of the following exemptions applies.

Once the buyer has the vehicle registered under his name he must pay to sell Texas. Who pays sales tax when selling a car privately in Illinois. Do you pay taxes when buying a car privately in Illinois.

However you do not pay that tax to the car dealer or individual selling the car. However there will be an audit by the illinois. Selling a vehicle in illinois.

The buyer must pay 95 to the secretary of state and a tax to the department of revenue. There is also between a 025 and 075 when it comes to county tax. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation.

Who pays sales tax when selling a car privately in Illinois. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Is it cheaper to buy a car in IL or MO.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. Both you and the buyer will need to complete the title assignment section. The amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you.

Vehicle sales tax for vehicles sold by a dealer Usually 625 but can vary by location. When an illinois resident purchases a vehicle from an out of state dealer and will title the car in illinois the sale and subsequent tax due is reported on form rut 25 when you bring the vehicle into illinois. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer.

Who pays sales tax when selling a car privately in illinois. For vehicles worth less than 15000 the tax is based on the age of the vehicle. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

If you sell it for less than the original purchase price its considered a capital loss. Private party sales within most states are not exempt from car tax but unlike dealer transactions the seller does not collect the car tax. Use the Illinois Tax Rate Finder to find your tax.

Illinois Private Party Vehicle Use Tax Step 6 Line 1 Other transaction types that may be reported on Form RUT-50 are listed below along with the required tax amount due. Used cars have had at least one other owner meaning they have history. Income Tax Liability When Selling Your Used Car.

When you sell your car you must declare the actual selling purchase price. If you are buying from a dealership the dealer will collect and pay the tax on your behalf while with private sales as the buyer you will be responsible for making the payment. However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000.

This tax is paid directly to the Illinois Department of Revenue. By law a dealer has 20 days to send your title transfer and sales tax to the secretary of state s office.

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)

Tips For Buying A Car In A Different State

How Do I Sell My Car Illinois Legal Aid Online

Illinois Used Car Taxes And Fees

Illinois Title Transfer Buyer Instructions Youtube

Free Vehicle Private Sale Receipt Template Word Pdf Eforms

What Is Illinois Car Sales Tax

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Illinois Bill Of Sale Forms And Registration Requirements

Free Illinois Bill Of Sale Forms Pdf

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

What S The Car Sales Tax In Each State Find The Best Car Price

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

Illinois Sales Tax Credit Cap Important Information

What Paperwork Do I Need To Sell My Car In Illinois Sell My Car In Chicago

How To Sell A Car In Illinois Metromile

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Vehicle Private Sale Receipt Template Word Pdf Eforms

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc